1、Industry definition and classification

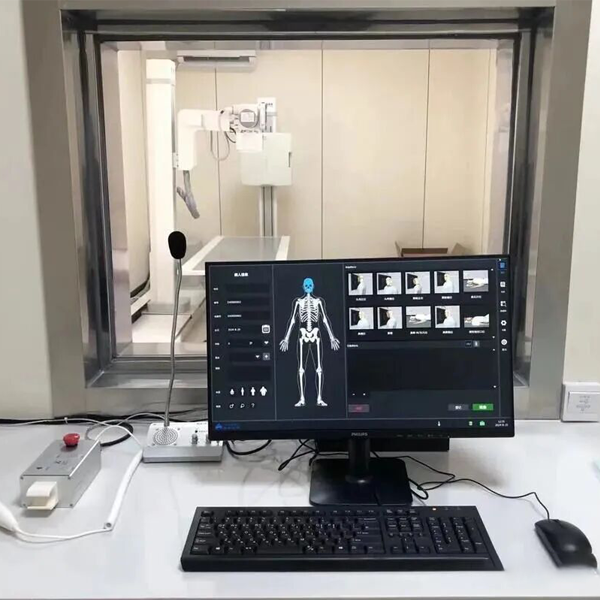

The DR industry refers to the research and development, production, sales, and service of medical imaging equipment, related consumables, and supporting systems that use digital detectors to directly obtain X-ray images and achieve image acquisition, display, storage, and transmission through computer processing. It is an important sub industry in the field of medical imaging equipment. DR, by directly converting X-ray photons into digital signals, is widely used in various parts of the body such as the respiratory system, skeletal system, digestive system, etc. It is the basic equipment for clinical diagnosis.

By product type, the DR industry in 2025 will mainly be divided into:

Flat panel DR: accounting for about 65% of the market, using amorphous silicon/amorphous selenium flat panel detectors, including suspended, column, mobile and other models.

CCD-DR: accounting for about 20% of the market, using CCD detectors, mainly used for basic inspections.

Dynamic DR: accounting for about 10% of the market, with dynamic imaging function, used for functional diagnosis.

Other specialized DR: accounting for about 5% of the market, including breast DR, oral DR, pet DR, etc.

Classified by technical level:

it can be divided into basic type (resolution ≤ 720P), standard type (1080P high-definition imaging), and high-end type (4K ultra high definition, AI assisted diagnosis). China will include DR in the management of Class II or III medical devices, which must be registered and certified by NMPA and comply with standards such as YY 9706 and YY/T 1040. By 2025, tablet DR will become mainstream in the market due to its high imaging quality and convenient operation, and the penetration rate of dynamic DR in the field of functional diagnosis will rapidly increase.

2、Market size and forecast

Global market performance:

The global DR market size is expected to reach 9.2 billion US dollars (approximately 64.4 billion yuan) by 2025, an increase of 8.2% from 8.5 billion US dollars in 2024, and a compound annual growth rate of about 8.0% from 2020 to 2025. From a regional distribution perspective, the North American market accounts for approximately 35% (about 3.22 billion US dollars), the European market accounts for 30% (about 2.76 billion US dollars), the Asia Pacific market accounts for 30% (about 2.76 billion US dollars), and other regions together account for 5%. The global DR shipment is expected to reach 49000 units, with a capacity utilization rate of approximately 85%. From the perspective of product structure, tablet DR accounts for 65%, CCD-DR accounts for 20%, dynamic DR accounts for 10%, and other specialty DR accounts for 5%. The penetration rate of intelligent devices (including AI assisted diagnosis) has increased from 20% to 25%, with an annual growth rate of 25%.

Market segmentation characteristics:

Divided by price range, low-end devices (below 500000 yuan/unit) account for 50%, mid-range devices (between 500000 and 1.5 million yuan/unit) account for 35%, and high-end devices (above 1.5 million yuan/unit) account for 15%. Divided by end users, procurement accounts for 35% in tertiary hospitals, 30% in secondary hospitals, and 35% in primary healthcare institutions. The segmented market for intelligent DR (including AI algorithms and remote consultation functions) is growing rapidly, with an annual growth rate of 20-25%.

3、Production process and technical characteristics

Core production process:

DR production mainly includes nine stages: detector manufacturing → high-voltage system integration → mechanical structure processing → electronic system integration → whole machine assembly → performance testing → aging testing → software burning → packaging certification. The manufacturing process of detectors includes amorphous silicon/amorphous selenium deposition, TFT array fabrication, packaging testing, etc. The resolution requirement is ≥ 1080P, the pixel size is ≤ 140 μ m, and the processing accuracy is ± 0.01mm. The high-voltage system integration process includes the installation of high-frequency generators X-ray tube assembly, cooling system debugging, etc., with a power requirement of ≥ 50kW and a tube voltage range of 40-150kV. The mechanical structure processing process includes frame forming, motion mechanism assembly, protective cover installation, etc., with a suspension stroke requirement of ≥ 2200mm, rotation angle ≥ 180 °, and dimensional tolerance ± 0.1mm. The electronic system integration process includes circuit board soldering, main control chip installation, signal processing module debugging, etc., with an image sampling rate requirement of ≥ 30fps and a delay of ≤ 100ms. The whole machine assembly process integrates all modules, shell packaging, and functional debugging, with an assembly accuracy of ± 0.2mm. The performance testing process includes image quality testing (spatial resolution ≥ 2.5lp/mm, radiation dose ≤ 0.5mGy), mechanical performance testing, functional testing, etc., with a pass rate of ≥ 98%. The sentence is:. The aging test is conducted for 72 hours of continuous operation, with a failure rate of ≤ 0.5%. The software burning process involves burning embedded operating systems, image processing algorithms, AI diagnostic modules, and other software onto the main control chip. The packaging and certification process includes radiation protection testing, packaging labeling, CE/FDA and other international certifications.

Technical characteristics and innovation: In 2025, the DR industry will present the following technological features:

High definition upgrade: The penetration rate of 4K ultra high definition imaging devices has increased from 15% to 20%, 1080P high-definition devices have become mainstream, and image clarity has been improved by 40%.

Intelligent development: The popularization rate of AI assisted diagnosis function has increased from 20% to 25%, the application rate of automatic recognition of lung nodules, fractures and other functions has increased from 30% to 40%, and the diagnostic efficiency has increased by 50%.

Low dose quantification trend: The popularization rate of low-dose imaging technology has increased from 60% to 70%, and the radiation dose of a single patient examination has been reduced by 30%.

Dynamic application: The proportion of dynamic DR has increased from 8% to 10%, and the diagnostic capability has been enhanced.

Portable development: The proportion of mobile DR has increased from 15% to 18%, and there has been an increase in bedside examination applications.

Technological development trend: From 2026 to 2030, DR technology will make breakthroughs in ultra high definition imaging (8K resolution), intelligence (AI assisted diagnosis throughout the entire process), low-dose (50% reduction in radiation dose), and multifunctional integration (multimodal fusion). It is expected that the accuracy of AI diagnosis will increase to 97% by 2026, portable devices will account for 25% by 2027, and the penetration rate of dynamic DR in primary healthcare institutions will reach 50% by 2028.

4、Analysis of Product Cost Structure

Raw material cost analysis: accounting for 60-65% of DR production costs, it is the core of cost composition. among which:

- Detector cost: Flat panel detectors, CCD detectors, etc. account for 35-40% of the total raw material cost. By 2025, the price of flat panel detectors (17 × 17 inches) will be approximately 80000 to 120000 yuan per unit, with an annual fluctuation of ± 15% due to technological barriers.

- High voltage system cost: High voltage generators, X-ray tubes, etc. account for 20-25%. The price of high voltage generators is about 50000-80000 yuan per set, and the price of tubes fluctuates by ± 10%.

- Mechanical structure cost: Rack, motion system, protective cover, etc. account for 15-20%, and the price of medical grade metal structural components is about 30000 to 60000 yuan/set, which is relatively stable.

- The cost of electronic components: main control chips, circuit boards, power modules, etc. account for 10-15%.

Taking a mid-range tablet DR with a terminal price of 800000 yuan as an example, the raw material cost is about 480000 to 520000 yuan (60-65%), including detectors of about 168000 to 208000 yuan, high-voltage systems of about 96000 to 130000 yuan, mechanical structures of about 72000 to 96000 yuan, and electronic components of about 48000 to 78000 yuan. In 2025, there will be significant fluctuations in raw material prices: flat panel detector prices will fluctuate by ± 15% annually due to chip supply, high-voltage generator prices will fluctuate by ± 10%, and tube prices will fluctuate by ± 8%. Top enterprises lock in 70% of their core material supply through annual framework agreements, with procurement costs 10-15% lower than spot purchases. However, small and medium-sized enterprises, due to their small procurement volume, have spot purchases accounting for as much as 60%, with costs 20-25% higher.

Labor and manufacturing costs: Direct labor costs account for 10-12%, including assembly workers, debugging workers, quality inspectors, etc. Skilled technicians earn a monthly salary of 6000-8000 yuan, engineers earn a monthly salary of 8000-12000 yuan, with an annual salary increase of 8-10%. Manufacturing costs account for 8-10%, including equipment depreciation (investment in precision machining equipment, testing equipment, etc. is about 3-8 million yuan, with an annual depreciation rate of 10%), factory rent, water and electricity expenses, and clean workshop maintenance costs. Through automation upgrades, top enterprises will reduce the proportion of direct labor to 8%, but equipment depreciation costs will correspondingly increase.

R&D and marketing expenses: R&D expenses account for 15-18%, mainly used for new product development, clinical validation, registration and application, etc. The registration and application fee for Class II medical devices is about 200000 to 500000 yuan, with a cycle of 6-12 months. The proportion of R&D investment in intelligent and high-end devices is higher, reaching 20-25%. Marketing expenses account for 5-7%, academic promotion expenses account for 3-5% of sales, and channel expenses (dealer rebates, hospital admission fees) account for 5-8%. The marketing expenses during the new product promotion period can account for up to 15%.

Terminal price structure: Taking a mid-range tablet DR with a terminal price of 800000 yuan as an example, the raw material cost is about 480000 to 520000 yuan (60-65%), the production and processing cost is about 80000 to 96000 yuan (10-12%), the R&D cost is shared by about 120000 to 144000 yuan (15-18%), the brand profit is about 160000 to 200000 yuan (20-25%), and the channel profit is about 40000 to 56000 yuan (5-7%). High end products (such as intelligent DR, priced at 1.5-3 million yuan/unit) have a higher brand premium, with a gross profit margin of 50-60%, but also higher R&D and clinical investment. The gross profit margin of low-end products (basic DR, priced at 300000 to 500000 yuan/unit) is only 25-30%, and the profit margin is compressed.

5、 Analysis of Upstream and Downstream Industrial Chain

Upstream supply chain: mainly includes core material suppliers such as detectors, high-voltage systems, and electronic components. Detector suppliers include Varex, Trixell, Yirui Technology, etc. In 2025, the annual demand for flat panel detectors in China is about 25000 sets, with a localization rate of 45%. High end detectors still rely on imports (mainly from Japan and the United States). High voltage system suppliers include Varex, Spellman, Wandong Medical, etc. The localization rate of high-voltage generators is 50%, while high-frequency generators still rely on imports from Germany and Japan. Electronic component suppliers include STMicroelectronics, Texas Instruments, Huawei HiSilicon, etc. The localization rate of main control chips is 20%, and high-end chips still rely on imports. Structural material suppliers include Baosteel Group and Jinfa Technology, with a localization rate of 80% for medical grade metal and plastic materials. The upstream technology threshold is high, with a gross profit margin of 50-60%, but the core components still rely on imports, which poses a “bottleneck” risk in the supply chain.

Midstream manufacturing: mainly includes ODM contract factories and brand manufacturers. China is one of the main production bases for DR worldwide, concentrated in cities such as Shenzhen, Shanghai, and Suzhou. ODM manufacturers include Lianying OEM factories, Wandong OEM factories, etc., with full process capabilities from design to manufacturing, with a gross profit margin of 35-45%. Brand manufacturers include domestic and foreign brands such as Lianying Medical, Wandong Medical, Mindray Medical, etc. They promote their products to the market through brand building and channel operation, with a gross profit margin of 40-50%. By 2025, Chinese ODM manufacturers will account for 60% of global production capacity, but in profit distribution, brand manufacturers will occupy the main part of the value chain, and OEM factories will have meager profits (net profit margin of 5-8%).

Equipment suppliers: including DR production lines, precision machining equipment, testing equipment, and other suppliers. Domestic equipment manufacturers such as Dazu Laser, Huagong Laser, and Tongkuai occupy 75% of the market share. The price of a single fully automatic production line is about 3-8 million yuan, which is 30-40% cheaper than imported equipment. However, high-end equipment such as high-precision optical testing equipment and automated assembly lines still rely on imports from Germany and Japan, with a localization rate of only 50%.

Downstream channels: including distributors (Sinopharm Holdings, Jiuzhou Tong), hospital direct sales, physical examination center direct sales, etc. By 2025, the proportion of distributor channels will be 40%, hospital direct sales will be 45%, physical examination center direct sales will be 10%, and other channels will be 5%. The gross profit margin of the channel segment is 20-30%, but the warehousing, logistics, and payment costs are high, with a net profit margin of only 8-12%.

Value distribution of the industrial chain: The gross profit margin of the upstream raw material link is 50-60%, but the technical barrier is high; The gross profit margin of the midstream manufacturing process is 35-45%, with significant economies of scale; The gross profit margin of downstream brand links is 40-50%, but there is a large investment in research and development and marketing; The gross profit margin of the channel segment is 20-30%, and the net profit margin is low. Overall, China has certain advantages in the manufacturing of complete machines, but there is still room for improvement in high-end detectors, core sensors, brand premiums, and other aspects.

6、 Industry Challenges and Difficulties

Cost pressure: Raw material costs account for 60-65% of DR production costs, and there will be significant price fluctuations for core materials such as flat panel detectors, high-pressure generators, and ball tubes by 2025. The price of flat panel detectors fluctuates by ± 15% annually due to chip supply, ± 10% for high-voltage generators, and ± 8% for tube prices. Labor costs continue to rise, with skilled workers earning a monthly salary of 6000-8000 yuan and an annual salary increase of 8-10%. In terms of manufacturing costs, the maintenance cost of clean workshops increases electricity expenses by 15%, and some companies’ annual environmental operating costs exceed 2 million yuan. The price war has led to a decrease in the gross profit margin of low-end products to 25-30%, causing some small and medium-sized enterprises to suffer losses.

Technical bottleneck: The core challenge is the dependence on imported high-end components. 60% of flat panel detectors, high-frequency generators, and main control chips rely on imports, mainly from Japan, the United States, and Germany. There is a 10-15% gap between domestic components and imported products in terms of performance, stability, and lifespan. Due to insufficient precision manufacturing technology, key technical indicators such as detector packaging technology and high-voltage system insulation technology, the yield rate of domestic enterprises is only 85%, while international giants can reach over 95%. The pressure of equipment upgrade requires an investment of 3-8 million yuan in fully automated production line equipment. Due to limited funds, small and medium-sized enterprises have outdated equipment (with an average service life of over 5 years), low production efficiency, and unit costs 20-25% higher than top enterprises.

Market competition: Product homogenization is severe, with 70% of products having similar functions and lacking differentiated selling points. The competition in basic tablet DR, CCD-DR and other fields is fierce, with over 80 companies, but most of them are small and medium-sized. The price war is fierce, and the price of basic tablet DR has been reduced to 300000 to 500000 yuan per unit, with a gross profit margin of only 25-30%. International brands dominate the high-end market with their technological patents and brand advantages, while domestic enterprises compete in the mid to low end market. The transparency of prices in e-commerce channels has intensified competition, with some products selling at prices lower than their cost online.

Market competition: Product homogenization is severe, with 70% of products having similar functions and lacking differentiated selling points. The competition in the fields of basic tablet DR, CCD-DR, etc. is very fierce, with more than 80 companies, but most of them are small and medium-sized enterprises. The price war is fierce, and the price of basic tablet DR has dropped to 300000 to 500000 yuan per unit, with a gross profit margin of only 25-30%. International brands dominate the high-end market with their technological patents and brand advantages, while domestic enterprises compete in the mid to low end market. The transparency of prices in e-commerce channels has intensified competition, with some products being sold online at prices below cost.

Talent shortage: The shortage rate of technical talents is 25%, and it is still difficult to recruit electronic engineers and optical engineers with a monthly salary of 8000-12000 yuan. The shortage rate of skilled technicians (assembly workers, debugging workers) is 20%, and it is still difficult to recruit them with a monthly salary of 6000 yuan. 50 year old senior technicians do not understand automation equipment, and young technicians lack practical experience, exacerbating the intergenerational gap. Top enterprises cultivate talents through school enterprise cooperation, internal training, and other methods, but the cycle is long and the cost is high.

Policy impact: Policy adjustments have a significant impact on the industry. The policy of centralized procurement has expanded its coverage, resulting in a 20-30% decrease in procurement prices for public hospitals and a compression of corporate profit margins. Policies such as medical insurance cost control and DRG payment reform have made hospital procurement more cautious. The adjustment of export tax rebate policies and the tightening of environmental protection policies have increased the compliance costs of enterprises by 10-15%. Trade frictions, tariff barriers, and other uncertainties pose risks to export enterprises.

Supply chain risk: 60% of core materials rely on imports, and there is uncertainty in the supply chain due to geopolitical and trade frictions. The risk of supply chain interruption increases due to force majeure factors such as epidemics and natural disasters. Inventory management is difficult, and core components such as flat panel detectors typically have an expiration date of 12-24 months, resulting in significant losses upon expiration. Although the multi-source procurement strategy can reduce risks, it increases procurement costs by 10-15%.

7、 Development Trends and Prospects

Technological development trend: From 2026 to 2030, DR technology will make breakthroughs in ultra high definition imaging (8K resolution), intelligence (AI assisted diagnosis throughout the entire process), low-dose (50% reduction in radiation dose), and multifunctional integration (multimodal fusion). It is expected that the accuracy of AI diagnosis will increase to 97% by 2026, portable devices will account for 25% by 2027, and the penetration rate of dynamic DR in primary healthcare institutions will reach 50% by 2028.

Market development trend: It is expected that the global DR market size will reach 12 billion US dollars by 2030, and the Chinese market size will reach 28 billion yuan, with a compound annual growth rate of about 8% from 2025 to 2030. The proportion of tablet DR will increase from 65% to 70%, the proportion of CCD-DR will decrease to 15%, and the proportion of dynamic DR will increase to 12%. The penetration rate of intelligent devices will increase to 35%, with an annual growth rate of 20-25%. The proportion of online channels will increase to 12%, mainly targeting overseas markets. The proportion of mid to high end products will increase from 15% to 25%, indicating a clear trend of consumer upgrading.

8、About us

Post time: Jan-23-2026